International Withholding Tax Recovery

Envisage is proud to be a key partner of WTax in Switzerland. WTax is the global leader in international withholding tax (WHT) recovery. www.wtax.ch

WTax is part of the VAT IT Group (www.vatit.com), which is the largest indirect tax recovery company in the world, employing over 1000 staff in 45 offices located in all major financial hubs.

WTax provides services for the recovery or “reclaim” of the withholding tax deducted by various tax authorities around the world. WHT is usually deducted on dividend and interest payments on investments. The percentage reclaimed is governed by the respective Double Tax Agreement (DTA) between the jurisdiction of the beneficial owner and the jurisdiction in which the investment is held.

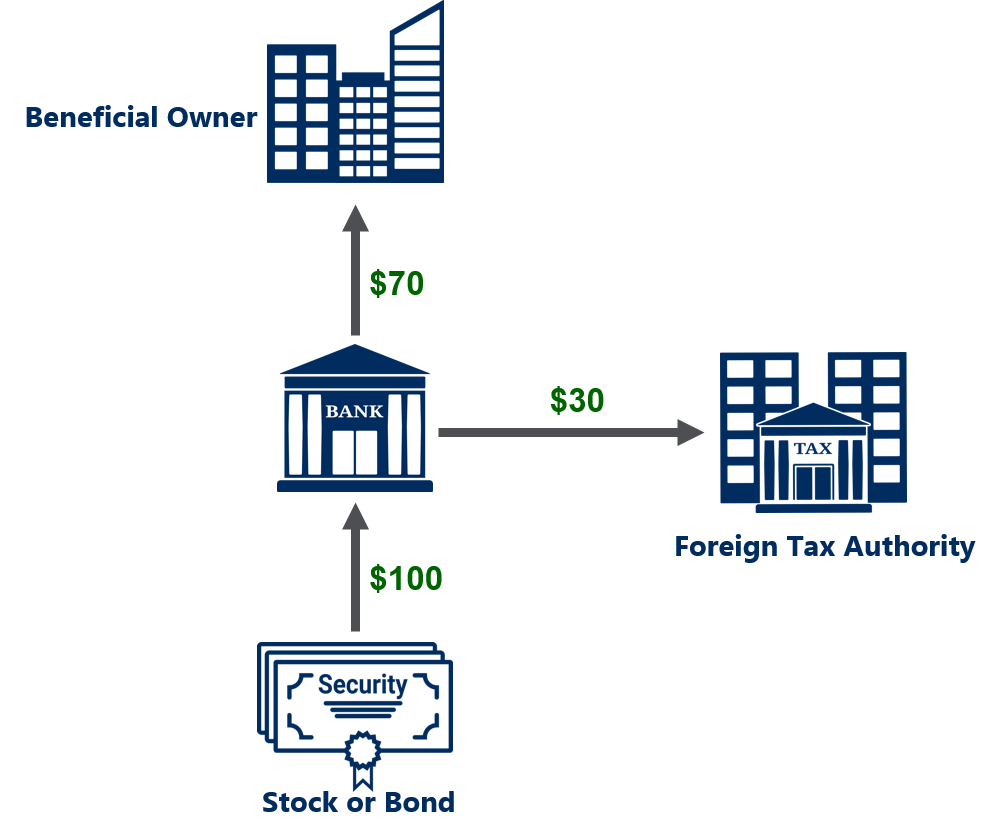

A beneficial owner (be it company, institution, private individual, insurance company, pension fund etc.) holds investment securities with a custodian bank. When those securities make periodic dividend or interest payments, the countries’ tax authority deducts a WHT on securities owned by non-residents. 30% in the example below.

The security in the portfolio pays a dividend or interest payment of $100. In this example, the tax authority deducts 30% from that payment, paid over to the authority by the bank. The bank pays the remaining 70% to the beneficial owner. It is up to the beneficial owner to claim the tax back. The process is set out below.

Recovery. Getting the tax back.

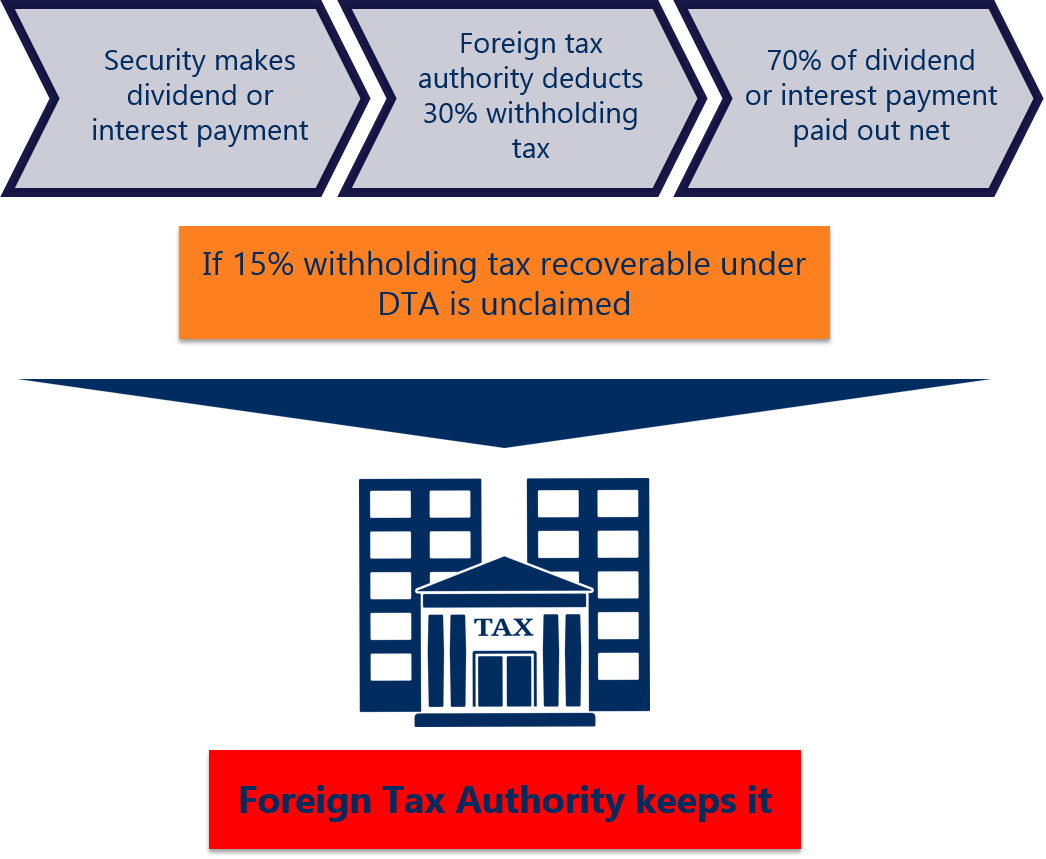

For most OECD nations, the DTA allows for the reclaim of an agreed percentage of the WHT by the beneficial owner. Generally, it’s about half (15%) of the tax withheld, as in the example below. The reimbursement must, however, be specifically claimed by the beneficial owner, or a third party on their behalf. This third party may be WTax.

Should the beneficial owner fail to claim the 15% back, the foreign tax authority keeps it. This is a direct loss to the beneficial owner. When the statue of limitations for that countries lapses, the money is lost forever.

Do custodian banks claim the tax back? Sometimes, yes; sometimes, no. If they do, it’s usually only for “easy” jurisdictions. If they don’t, the issues are multiple. For example :

- Tax reclaim is time consuming, involving onerous documentation and procedural requirements – it costs the bank to do it as well

- A bank is not a tax advisor and cannot dispense tax advice – relevant for more complex reclaims

- Often requires very specialized knowledge

- Bank has only a limited interest in reclaiming the tax – it’s not their money

- Bank usually cannot charge for the service – what cannot be charged for is understandably assigned a low priority

What happens if the tax is not reclaimed within the specified time period? It is lost. The claim lapses after the statute of limitations and the tax authority keeps the money. This is a definite, quantifiable loss suffered by the beneficial owner. It is a loss that the beneficial owner is usually not even aware of.

WTax Involvement.

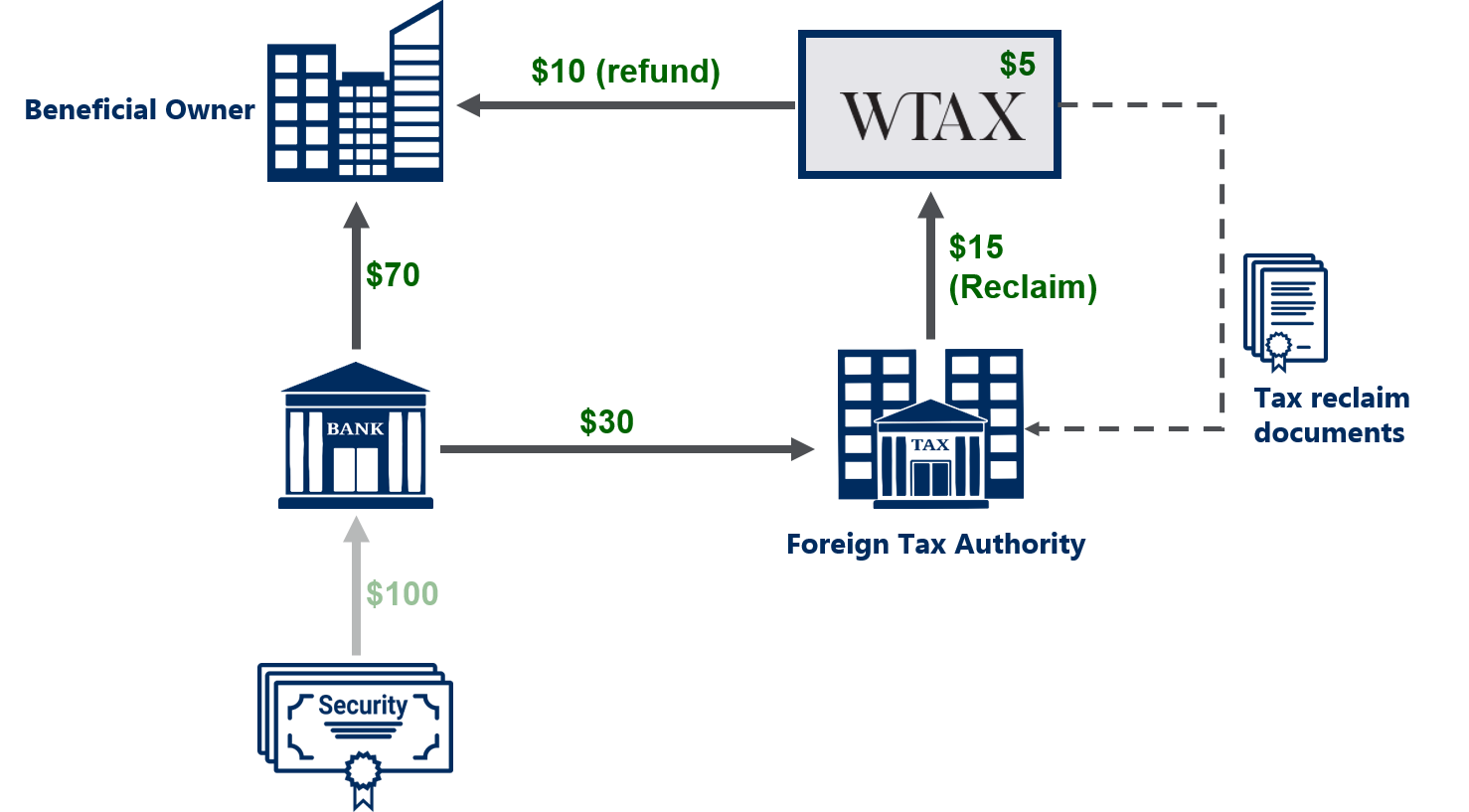

When WTax is engaged, WTax recovers the tax claimable under the DTA. In this case, again, 15%. The tax recovery process is depicted below.

WTax submits the necessary reclaim documentation to the tax authority. The tax authority processes the claim and pays out the amount owing under the existing DTA.

The example used here is fairly representative: a 30% withholding tax with half recoverable under the DTA.

To explain more fully, tax authorities around the world generally deduct WHT from interest and dividend payments. All too often, they keep it. Why? Because no-one goes and gets it back.

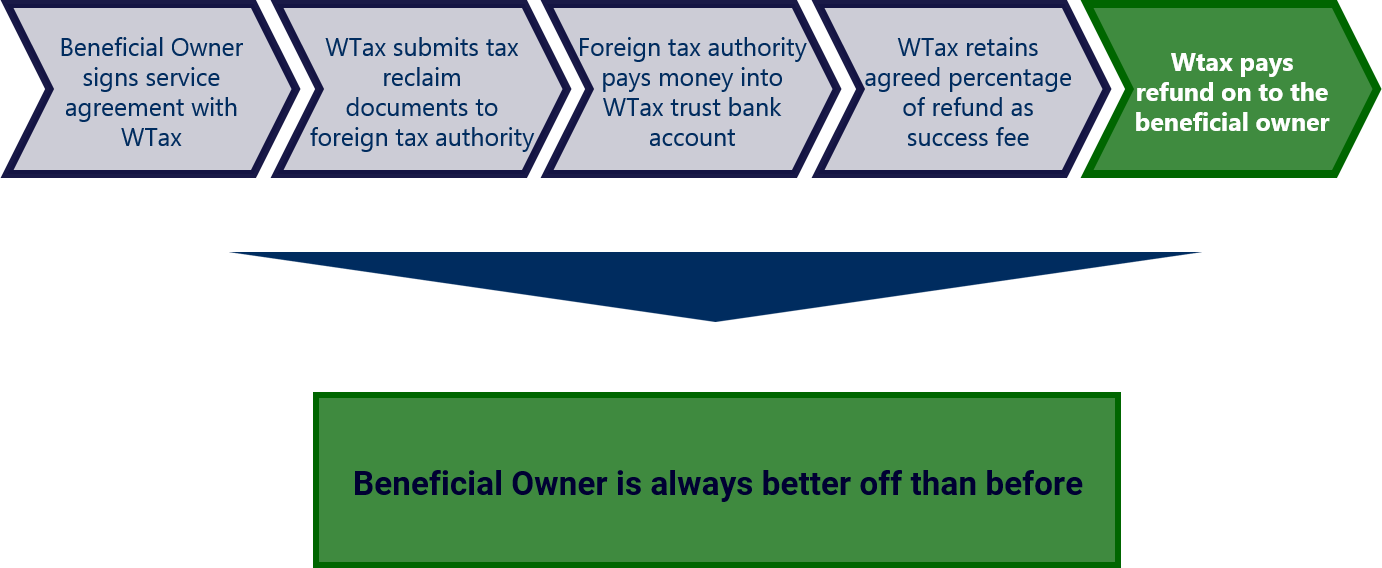

To summarise:

- WTax submits the tax reclaim documents on behalf of the investor (beneficial owner)

- WTax receives the tax refund into its trust account

- WTax deduct their success fee

- WTax passes the balance on to the beneficial owner

The numbers vary from country to country, but the process remains the same.

When engaged, the beneficial owner gives WTax a power of attorney to submit claims to the foreign tax authorities.

The reclaim of greater amounts of WHT has really only become pragmatically possible over the last several years because of changes in the tax authorities themselves. It is relatively new. These changes, upgrades in IT, processes and procedures have been brought about by the requirements of Automatic Exchange of Information (AEoI) under the U.S. Foreign Account Tax Compliance Act (FATCA) and the OECD Common Reporting Standard (CRS). Plus, the raft of recent financial transparency legislation. It may be onerous for financial institutions but is proving rather beneficial to institutions and people owning dividend and interest producing assets around the world. The automatic exchange of information is starting to work both ways.

The value add can be very significant. In the case of one large asset manager, WTax was able to reclaim more than the total amount of what was then being reclaimed by the custodian bank. The benefit increase was a doubling of total reclaims.

WTax works on a success fee basis only i.e. no refund, no cost. Reclaims are performed using all available methodologies, supported by 45 wholly-owned offices around the world, with close relationships with the tax authorities in those countries. Plus, over 1,000 staff, 600 of whom are dedicated to claims processing alone. WTax leverages decades of experience and long-standing relationships to achieve the best possible results for its clients.

In most cases, WTax is happy to perform a gap analysis at no cost. WTax analyses the current situation, using actual dividend and interest income data, showing quantitatively exactly what the custodian bank or other providers are missing. Clients are often surprised when shown the additional value. The additional benefit is provided because WTax recovers from so many more jurisdictions using all available methodologies.